BEWARE OF USING MONEY FROM YOUR IRA OR 401(K) TO PAY DEBTS

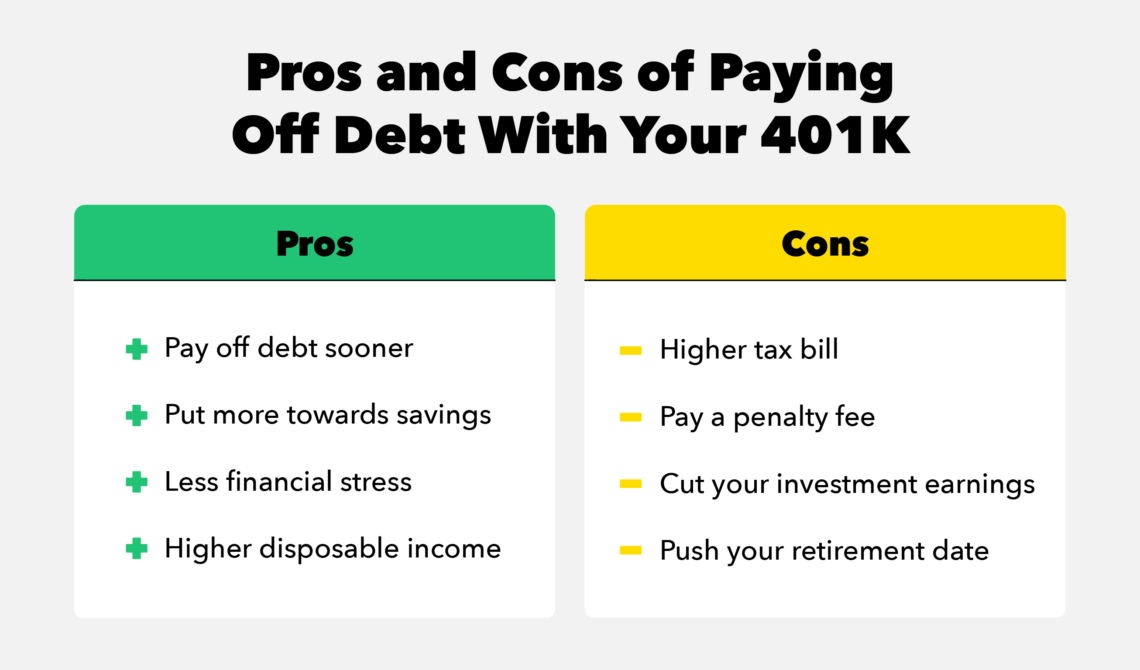

This can be a costly error. Using retirement funds to pay off debts can hurt you in numerous ways. The vast majority of retirement accounts are exempt. This means your creditors cannot get at them and you won’t lose them if you file for bankruptcy.

Using retirement money to pay debts that can be discharged in bankruptcy, like credit card and medical debt, rarely makes sense. If you file for bankruptcy, you can eliminate the debt without spending any of your retirement.

If your IRA or 401(k) balance isn’t enough to get you out of your financial mess, you may end up needing to file for bankruptcy anyway, which means you will have completely wasted your retirement money. Using retirement funds to pay debt jeopardizes your future when you will be in more need of the funds due to lack of other income.

The withdrawal from the IRA or 401(k) counts as income on which you will owe taxes and possibly even an early withdrawal penalty. Depending on how large the amount is, the added income could affect your ability to file Chapter 7 bankruptcy for a period of six months. During that period, you will be exposed to lawsuits and judgments from the creditors.

Click Here to learn more about the law firm.

Click Here to view our published books.