F Reorganization Expertise for S Corporations: Maximize Your Tax Advantages

F Reorganization Expertise for S Corporations: Maximize Your Tax Advantages

Navigating the Complex World of F Reorganizations

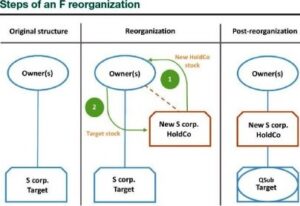

Just like mastering the game of Othello, understanding F reorganizations takes patience and expertise. Essential for the strategic purchase and sale of S corporations, F reorganizations involve intricate IRS rules that, when navigated correctly, can offer significant tax benefits.

Unlike the commonly assumed necessity of a QSub election, our law firm elucidates why bypassing this step does not detract from the legitimacy of an F reorganization. This insight not only simplifies the process but also opens the door to optimizing your transaction’s tax efficiency.

Why Opt for an F Reorganization?

The primary allure of F reorganizations lies in their ability to maximize tax benefits and mitigate risks associated with the restructuring of S corporations. For buyers eager to enhance depreciation or amortization deductions following the acquisition of a closely held S corporation, F reorganizations present a valuable alternative to the limitations posed by section 338(h)(10) and section 336(e) elections.

Comparative Advantage of F Reorganizations

F reorganizations stand out by offering a pathway to treat stock sales as asset sales, enabling the step-up in basis of assets to their fair market value without the constraints encountered in other tax election strategies. By exploring the nuances of each alternative and their respective restrictions, our law firm guides clients through optimizing their restructuring endeavors for maximum tax advantage.

Advocating for Simplification

In light of the unnecessary complexities introduced by the QSub election in F reorganizations, our firm advocates for IRS guidance to streamline the process. Removing this requirement would not only facilitate compliance but also enhance the efficiency of transactions involving S corporations.

Connect with Our Legal Experts on F reorganization for S corporations

At our law firm, we specialize in the intricacies of F reorganizations for S corporations. Our expertise ensures that your business restructuring or sale maximizes its tax benefits while minimizing legal hurdles. Whether you’re navigating the decision to elect a QSub or seeking to understand the full scope of your options under F reorganization rules, our team is here to guide you.

Let’s Maximize Your Business’s Tax Efficiency

Embarking on an F reorganization or restructuring your S corporation presents a pivotal opportunity to enhance your transaction’s tax benefits. Our legal experts are at the forefront of navigating these complex regulations, ensuring your business achieves its optimal tax position.

Ready to Optimize Your S Corporation’s Tax Position?

Unlock the full potential of your business sale or restructuring with our legal expertise in F reorganizations. Contact us now to transform your tax strategy and secure the future of your business. Let our knowledge be the key to your success. We can help with your F reorganization for S corporations.

CLICK HERE for information regarding books published by Attorney Ronald Cook.

CLICK HERE to contact the law firm.