Absolute Priority Doesn’t Require an Individual Debtor to Pay for Exempt Property

Taking sides on an issue where the lower courts are divided, the Ninth Circuit Bankruptcy Appellate Panel held that an individual in chapter 11 may confirm a plan and “retain exempt property without making a commensurate ‘new value’ contribution.” [Emphasis added.]

A real estate broker filed a chapter 11 petition to deal with priority tax claims and creditors claiming $260,000 for fraud and breach of contract. The debtor claimed a $150,000 Arizona homestead exemption in a home allegedly worth $300,000. The home was subject to a $156,000 mortgage.

The debtor filed a chapter 11 plan calling for a third party to contribute $15,000 to increase the distribution to unsecured creditors to about 5%. The contribution was designed to represent “new value” enabling the debtor to retain nonexempt property.

Dominated by creditors claiming $260,000, the unsecured creditor class rejected the plan, compelling the debtor to cram down the plan on unsecured creditors under Section 1129(b)(2)(b). Based on that section and virtually every requirement in Section 1129(a), the creditors objected to confirmation.

Bankruptcy Judge Brenda Moody Whinery of Tucson, Ariz., overruled the objections and confirmed the plan.

Related Stories

April 9, 2024

Title: The Alarming Rise of Identity Theft: A 2024 Perspective In recent years, the threat…

July 27, 2022

IRS Fresh Start Initiative Program, resolving IRS tax debts. Do You Need a Fresh Start…

June 9, 2022

IRS First Time Penalty Abatement – FTA The first-time penalty abatement (FTA) waiver is an…

March 26, 2022

If you filed a chapter 7 bankruptcy, look into filling IRS form 982 When you…

Posted in: Debt & Bankruptcy

March 26, 2022

DID SOMEONE FILE FOR UNEMPLOYMENT BENEFITS UNDER YOUR NAME? If you discover that someone has…

February 3, 2022

RICO suit, McKinsey In a decision last week, the Court of Appeals for the Second…

December 17, 2021

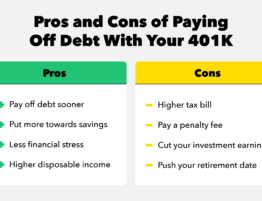

BEWARE OF USING MONEY FROM YOUR IRA OR 401(K) TO PAY DEBTS This can be…

Posted in: Debt & Bankruptcy

December 17, 2021

How to Spot Student Loan Scams. Things you can do to protect yourself. “Enroll now…

Posted in: Debt & Bankruptcy

April 9, 2024

Title: The Alarming Rise of Identity Theft: A 2024 Perspective In recent years, the threat…

July 27, 2022

IRS Fresh Start Initiative Program, resolving IRS tax debts. Do You Need a Fresh Start…

June 9, 2022

IRS First Time Penalty Abatement – FTA The first-time penalty abatement (FTA) waiver is an…

March 26, 2022

If you filed a chapter 7 bankruptcy, look into filling IRS form 982 When you…

Posted in: Debt & Bankruptcy

March 26, 2022

DID SOMEONE FILE FOR UNEMPLOYMENT BENEFITS UNDER YOUR NAME? If you discover that someone has…

February 3, 2022

RICO suit, McKinsey In a decision last week, the Court of Appeals for the Second…

December 17, 2021

BEWARE OF USING MONEY FROM YOUR IRA OR 401(K) TO PAY DEBTS This can be…

Posted in: Debt & Bankruptcy

December 17, 2021

How to Spot Student Loan Scams. Things you can do to protect yourself. “Enroll now…

Posted in: Debt & Bankruptcy